Unified Payroll for ASEAN & Beyond

One Platform. Multiple Countries. Seamless Payroll

Why Payobook

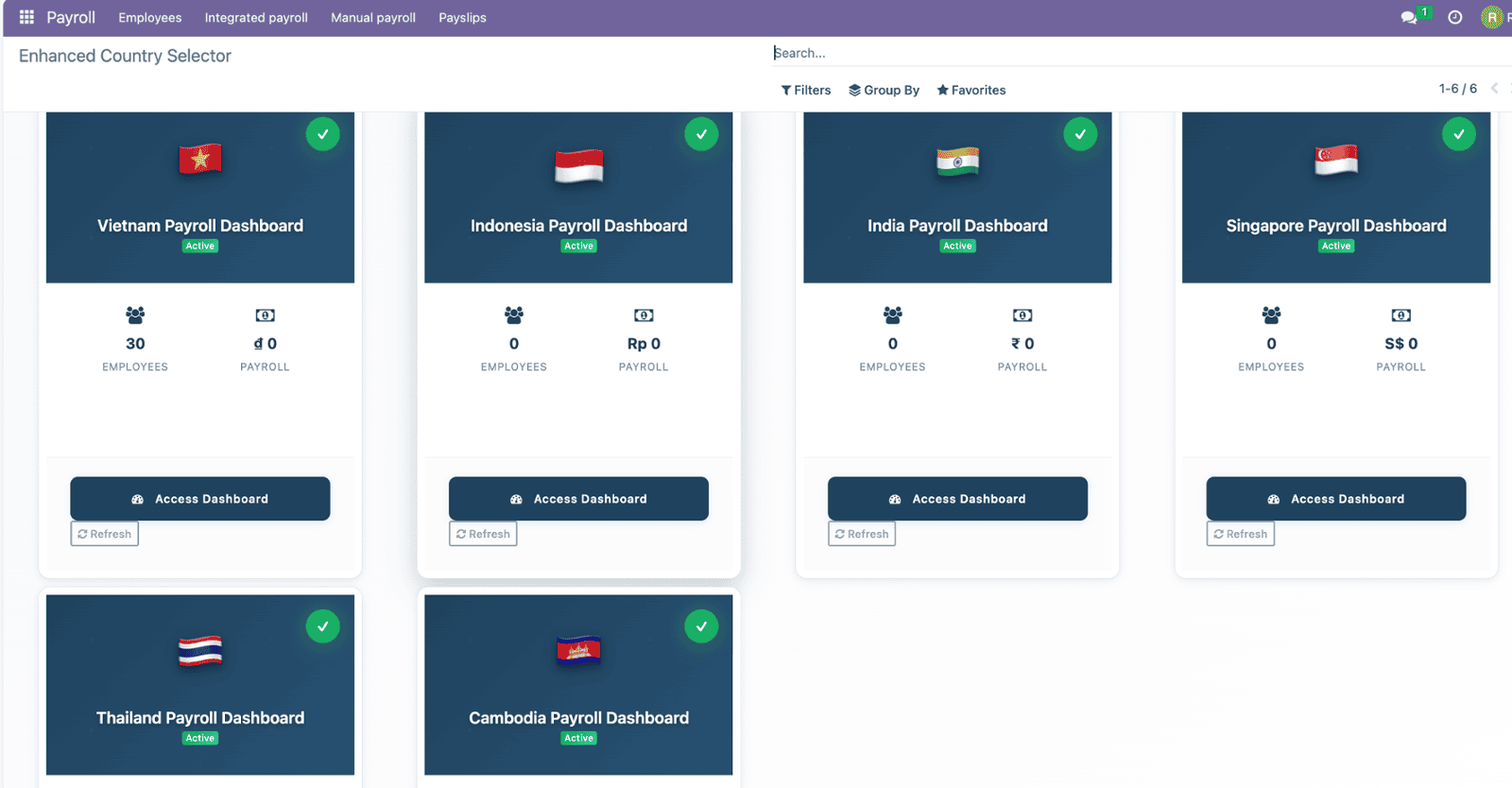

Managing payroll across borders is complex — different laws, currencies, and compliance rules create costly inefficiencies. Payobook solves this with a single cloud-based payroll platform localized for Vietnam, Laos, Cambodia, Singapore, Australia, Indonesia, and Thailand.

Built by IADCX,

- Payobook empowers finance and HR teams to:

- Standardize payroll across regions

- Ensure 100% legal compliance per country

- Gain unified visibility with real-time dashboards

Core Features

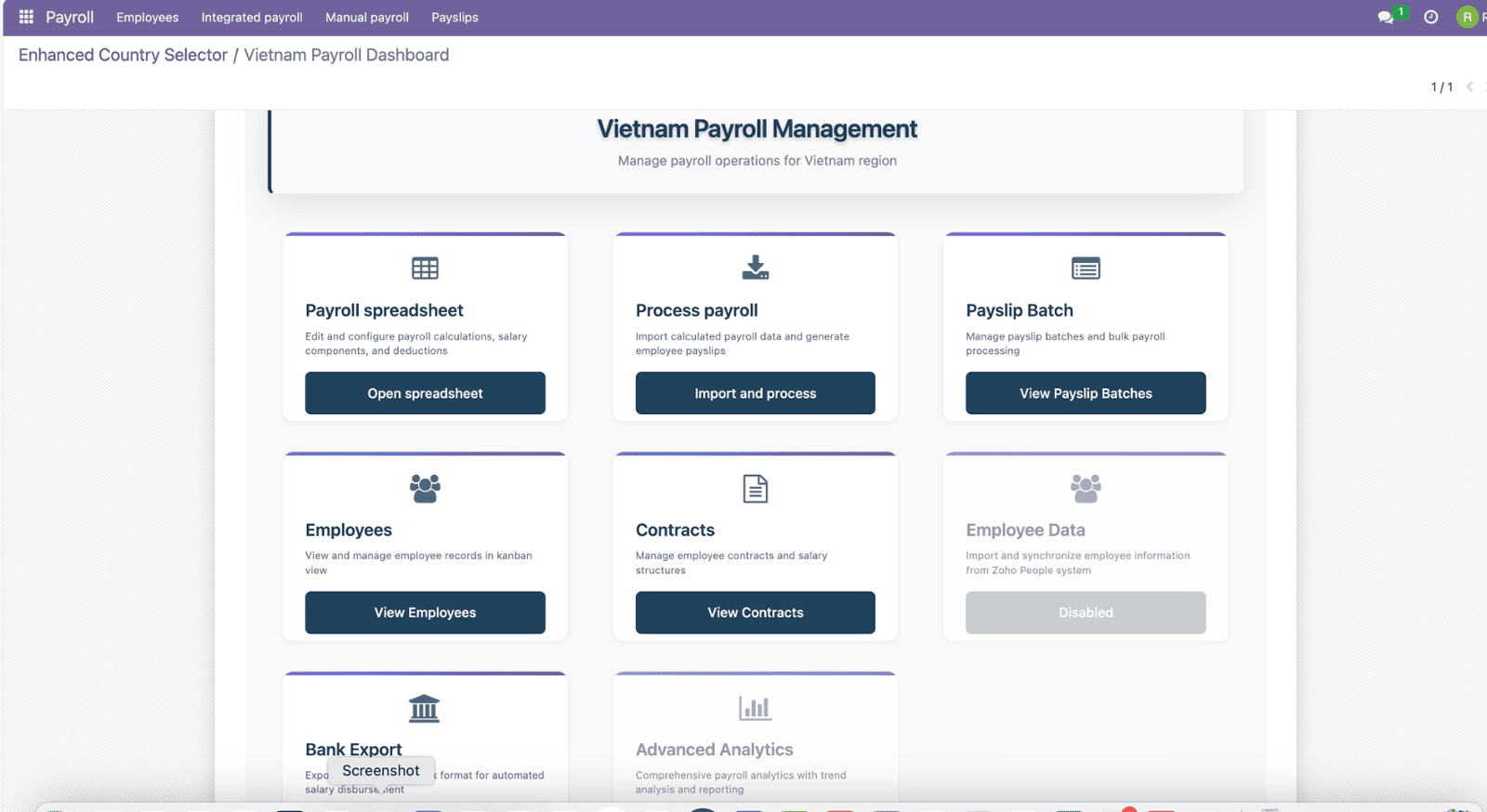

- Unified Multi-Country Payroll Engine

- Local Compliance & Statutory Updates

- Multi-Currency & Auto-Conversion

- Employee Self-Service Portal

- API Integrations

Unified Payroll Intelligence

Secure Technology, Seamless Integration, and AI-Driven Insights

Benefits at a Glance

- Greater Accuracy: Reduces human errors through automated validation and anomaly detection.

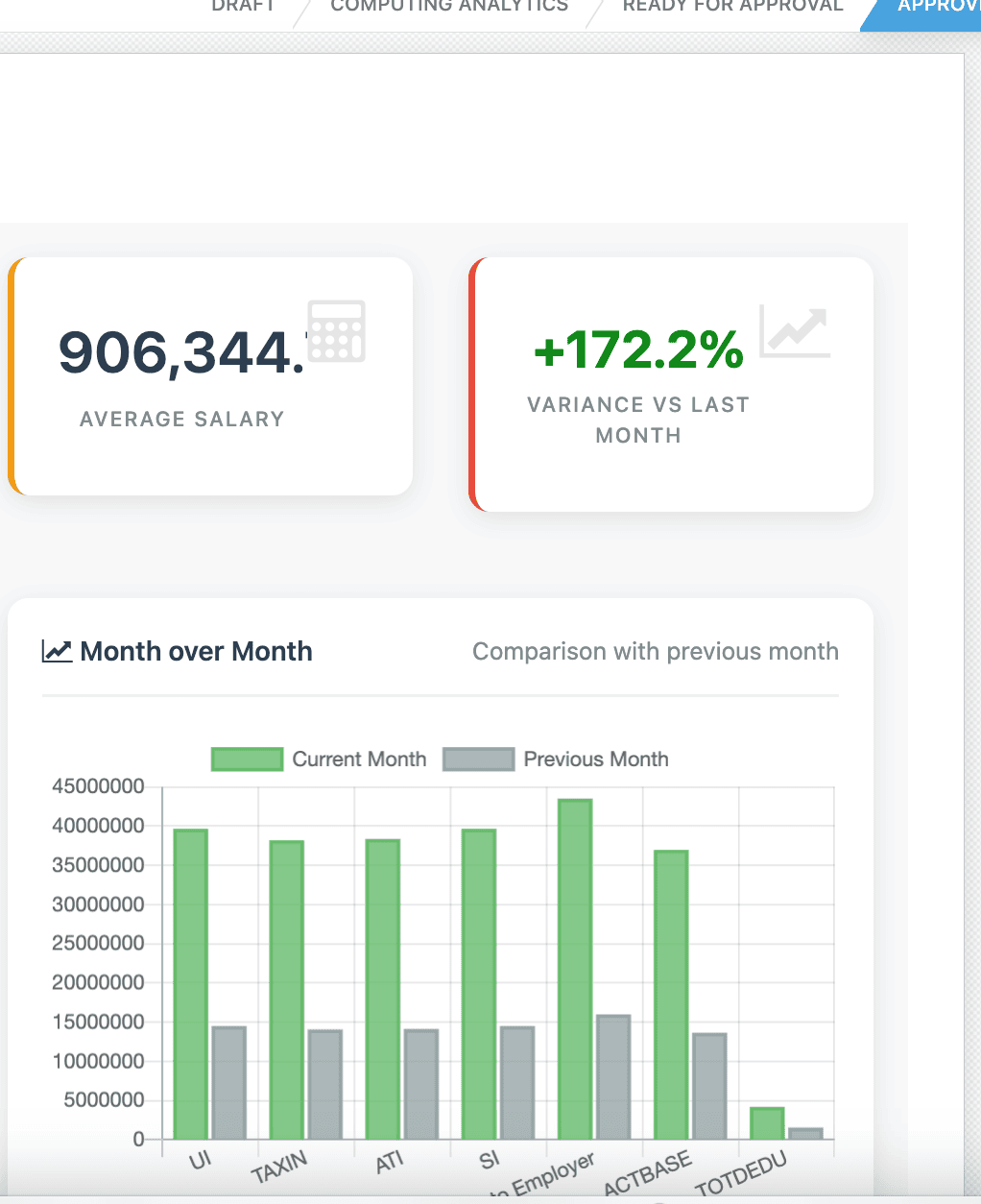

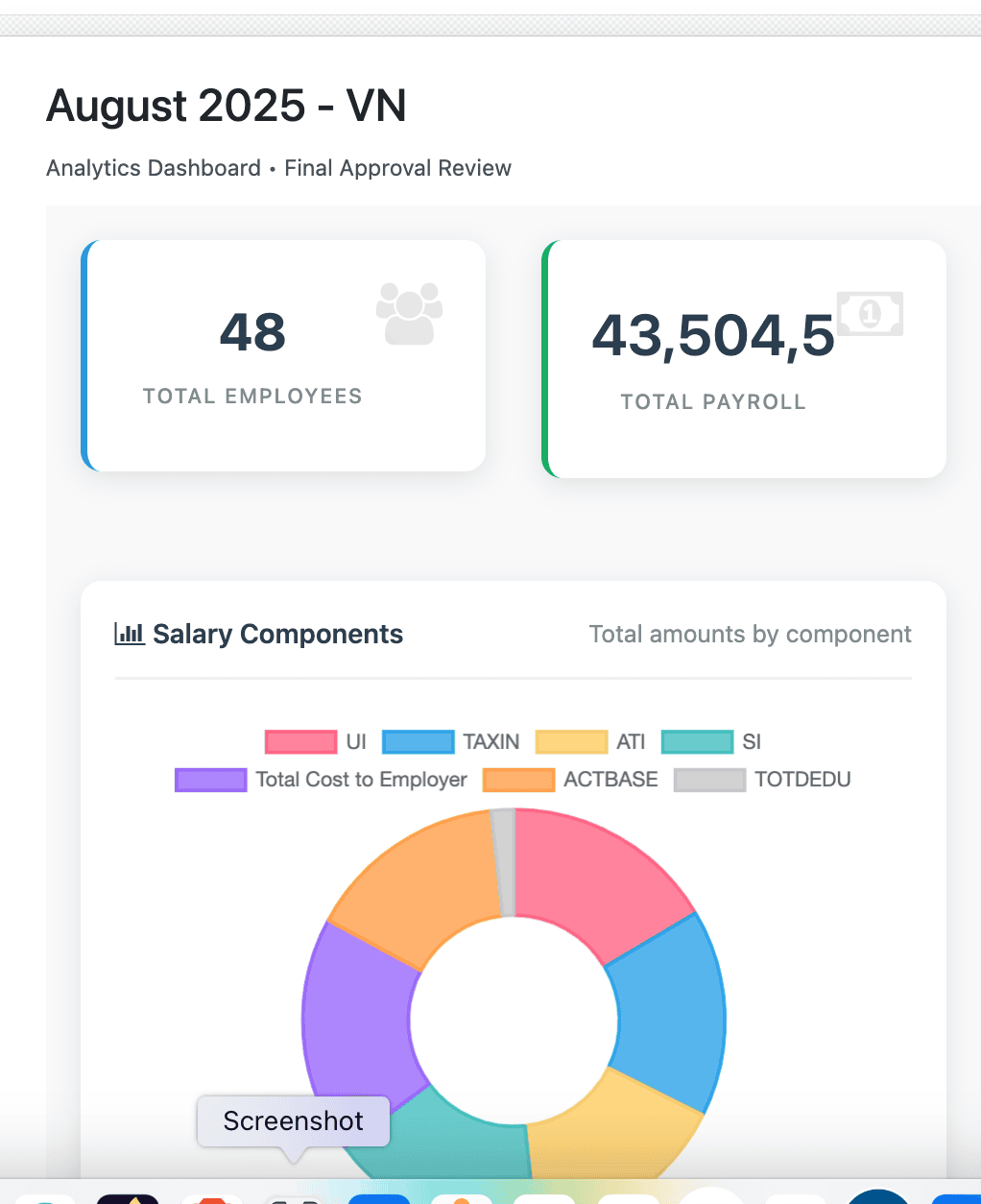

- Smarter Decisions: Provides real-time, data-driven insights for finance and HR planning.

- Compliance Confidence: Keeps payroll aligned with changing regional tax and labour laws.

- Cost Optimization: Identifies inefficiencies and helps control payroll expenses across countries.

- Strategic Visibility: Offers leadership a unified view of workforce trends and financial performance.

Integration Ready

- Seamless ERP Connectivity: Works smoothly with Zoho, SuccessFactor, MISA and Workday.

- API-Ready Platform: Enables easy data sync with HR, attendance, and accounting systems.

- E-Invoice Compatibility: Integrates with Viettel, VNPT, IRAS, and ATO e-invoicing networks.

- Communication Integration: Connects via Zalo, Microsoft Teams, Slack, and WhatsApp for alerts.

- Unified Data Flow: Eliminates duplicate entries and ensures consistent payroll information across systems.

Smart Analytics

- Predictive Payroll Forecasting: AI anticipates future payroll costs and cash flow needs across countries.

- Anomaly Detection: Automatically flags pay errors, duplicates, or compliance mismatches before processing.

- Cross-Country Cost Insights: Compares labour costs in real time across Vietnam, Singapore, Indonesia, and others.

- Regulatory Intelligence: AI tracks tax and labour law updates, sending proactive compliance alerts.

- Workforce Trend Analysis: Identifies patterns in overtime, turnover, and benefits to optimize HR decisions.

Technology Highlights

- Cloud or On-Premise Deployment: Flexible hosting in Vietnam, Singapore, or Australia.

- Multi-Country Payroll Engine: Unified logic with local compliance layers for each nation.

- AI-Powered Analytics: Intelligent insights, error detection, and forecasting built in.

- Scalable Architecture: Handles 50 to 10,000+ employees across multiple branches.

- Open API Framework: Enables fast integrations and custom automation workflows.

Security & Compliance

- End-to-End Encryption: AES-256 data encryption for all transactions and reports.

- Role-Based Access Control: Restricts visibility by role, branch, department or country.

- Two-Factor Authentication: Ensures secure login for all administrators and employees.

- Data Localization: Regional hosting compliant - Personal Data Protection Compliant

- Full Audit Trail: Tracks every change for transparency and compliance verification.